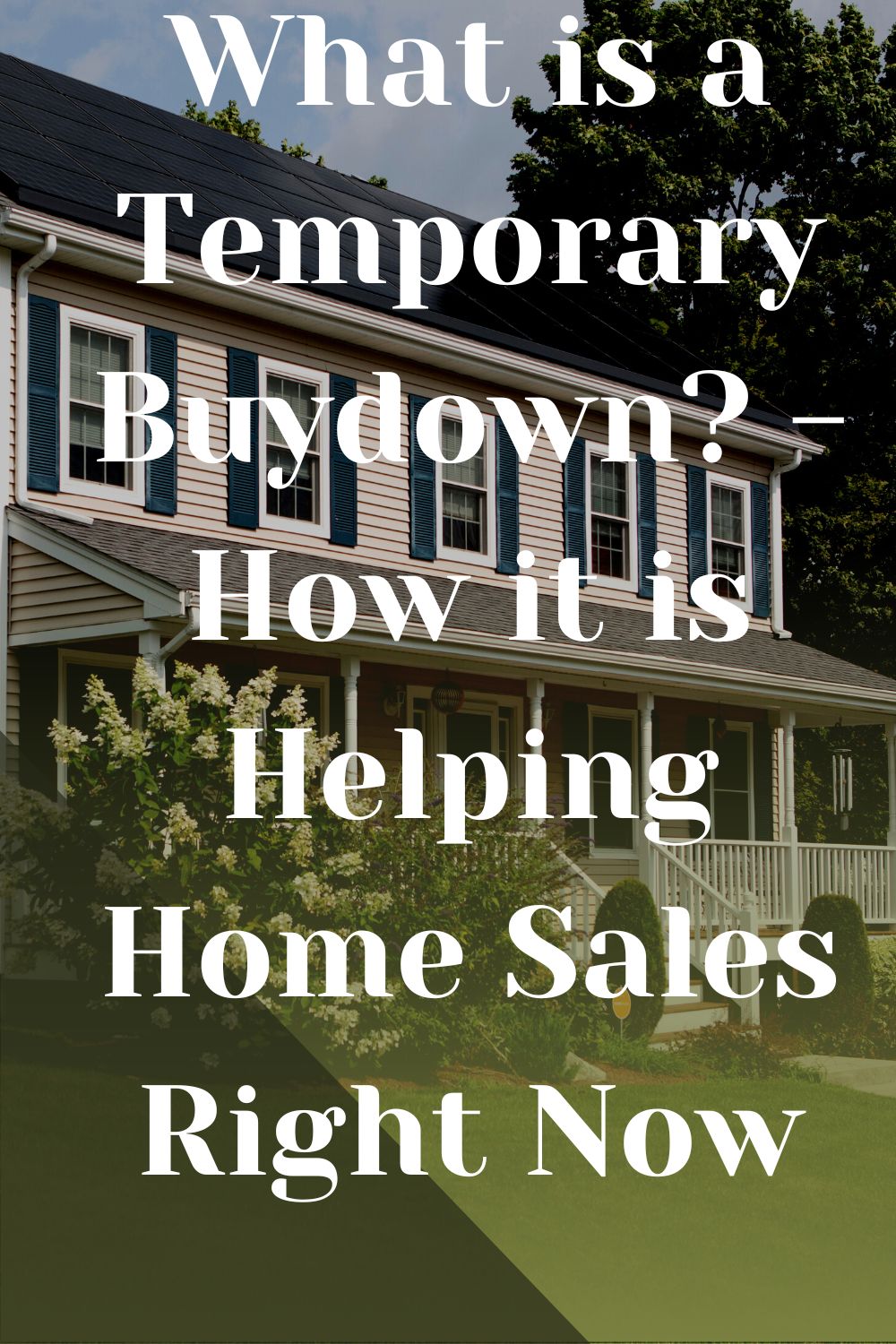

27+ temporary buydown mortgage

Your browser is currently set to block cookies. This mortgage calculator allows you to run different temporary buydown scenarios including interest rate loan amounts and buydown type.

Temporary Subsidy Buydown Mortgages Marimark Mortgage

7000 more than the buyer wants to pay.

. As a compromise the seller pays for a 2-1 buydown on. Our guided questionnaire will help you create your mortgage release contract in minutes. The 3-2-1 buydown falls into this category because it generally works.

Create your mortgage release contract with our template. Youll notice that their names correspond with the periods of lower ratesso a 3-2-1. Trade Us Your Payments For A Lump Sum.

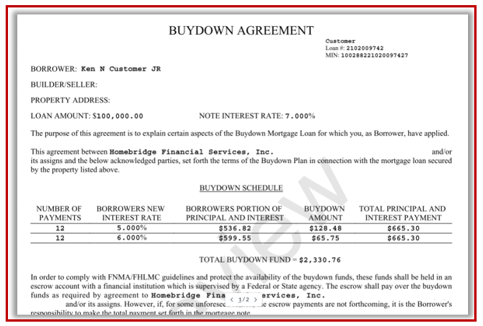

The interest payments are reduced for the first few years in exchange for a cash deposit. Contact Us For A Free Quote. The most common is called a 2-1 buydown but theres also a 3-2-1 buydown 1-1-1 buydown 1-0 buydown and 15-05 buydown.

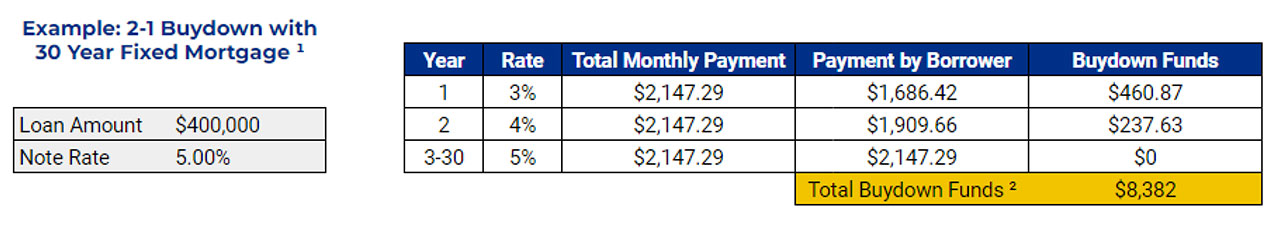

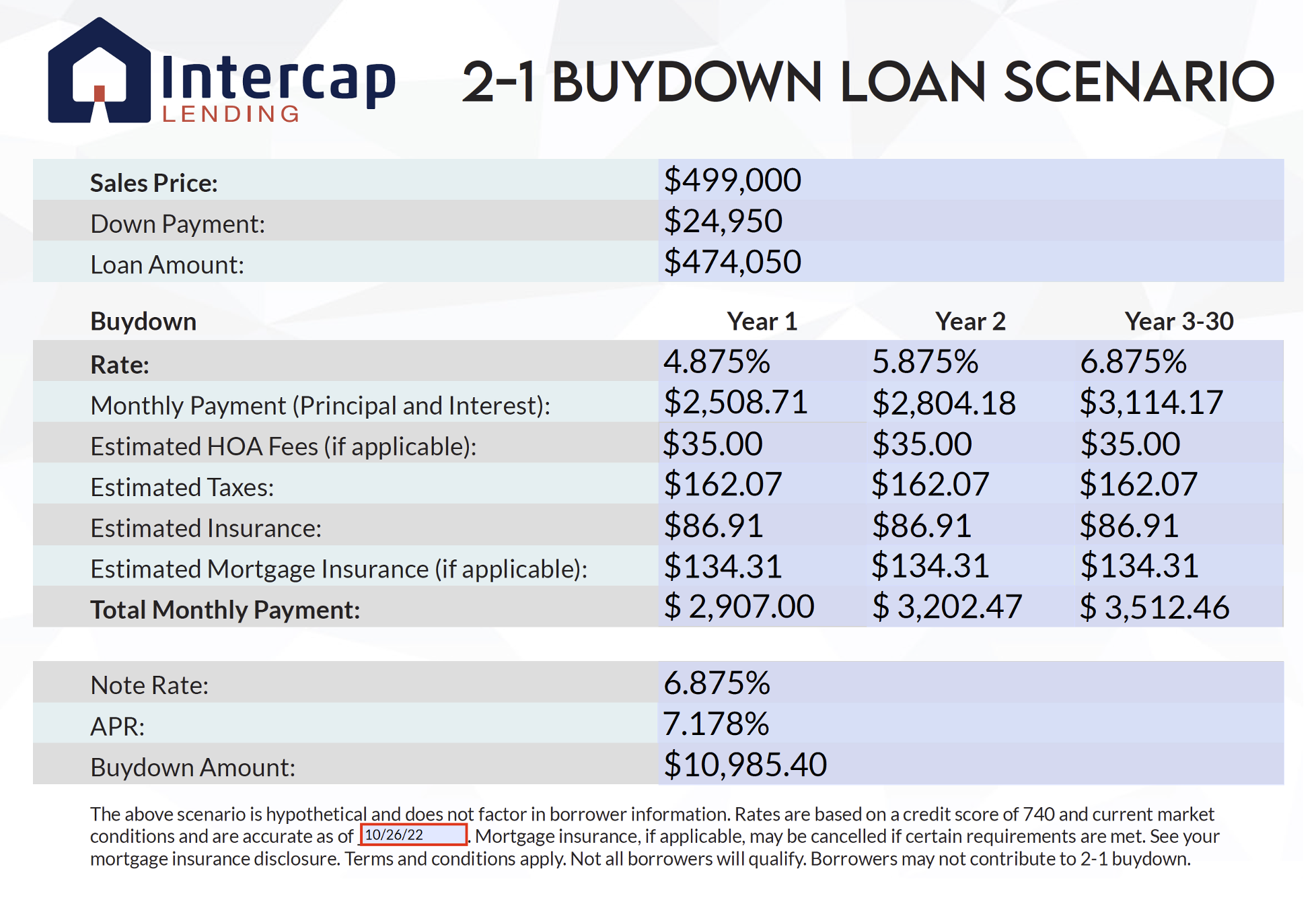

Contact Us For A Free Quote. Ad We Buy Mortgages Trust Deeds Land Contracts. Web A 2-1 buydown is a type of financing that lowers the interest rate on a mortgage for the first two years before it rises to the regular permanent rate.

Web We offer five types of Temporary Buydowns through Rate Reduce. The points paid upfront reduce the interest rate by 1 for. You need to allow cookies to use this service.

Web There are three common arrangements for temporary mortgage buydowns. Comparisons Trusted by 55000000. October 27 1999 Revised January 31 2005 December 12 2006 Reviewed.

Web Permanent buydown with Temporary buydown mortgage loan options. The buyer pays the price the two sides are stuck at. Web Refer to the Selling Guide for information on allowable sources of temporary buydown funds.

Explore Quotes from Top Lenders All in One Place. Web A temporary buydown loan makes it easier for you to budget your monthly expenses because it is more flexible. Web Common temporary buydown terms are 2-1 and 1-0 where the first number is the rate reduction you receive in the first year and the second number is the rate.

Our Goal Is To Find You The Best Deal With No Added Stress. Web 3-2-1 Temporary Buydown Calculator. Web A temporary buydown resolves the impasse.

Web A 3-2-1 buydown enables a buyer to pay less interest on their mortgage for 3 years after obtaining the loan. See Guide Section 630218 for information on the delivery and pooling requirements for mortgages with a temporary buydown plan. Web Heres what you should consider when it comes to a permanent mortgage buydown.

They all offer a period of time with a lower rate and work similarly. Cookies are small text files stored on your. Begin Your Loan Search Right Here.

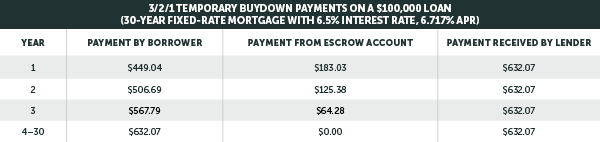

Ad Is your mortgage fully paid. Web The 3-2-1 Temporary Buydown reduces the buyers interest rate by 3 for the first year of their loan 2 for the second year and 1 for the third year. Ad Get the Right Housing Loan for Your Needs.

Ad We Buy Mortgages Trust Deeds Land Contracts. Web A buydown is a mortgage-financing technique where a buyer pays a lower interest rate either in the first few years of a mortgage loan temporary or over the. Then they gradually increase over the course of a.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Trade Us Your Payments For A Lump Sum. Web A temporary buydown is an effective way to use excess cash to reduce the initial monthly payment.

Web Temporary Buydown This strategy allows you to reduce the mortgage rate on a temporary basis. Compare Offers Side by Side with LendingTree. A common temporary buydown is a 3-2-1 meaning the mortgage payment in.

Web 1 day agoCommon temporary buydown terms are 2-1 and 1-0 where the first number is the rate reduction you receive in the first year and the second number is the rate. Web Basically a temporary buydown helps people qualify for mortgages due to a smaller initial monthly payment. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web A temporary buydown is when a party in a mortgage transaction pays a lump sum in order to reduce the interest rate temporarily for early years of the loan. A 3-2-1 buydown a 2-1 buydown and a 1-0 buydown Below is an. Choose between a 3-1 or 2-1 temporary rate buydown.

Lock Your Rate Today. Ad 10 Best House Loan Lenders Compared Reviewed. Our Goal Is To Find You The Best Deal With No Added Stress.

Web We cant sign you in. Get Instantly Matched With Your Ideal Mortgage Lender. Discount points are paid to the lender in exchange for a lower rate.

Mortgage Loan Temporary Buydowns High Interest Rate 3 2 1 0

Fairway Rate Rescue Fairway Independent Mortgage Corporation

.pdf.png?width=1545&name=Temporary_Buydown-5.75_Rate_Hendrick_Team%20(2).pdf.png)

What Is A 2 1 Buydown And How Does It Make Homeownership More Affordable

22 31 May Product Highlight Temporary Interest Rate Buydowns Pcg

Temporary Buydowns Theresa Springer

What Is A Temporary Buydown Mortgage Guild Mortgage Blog

Rate Buydown Intercap Lending

What Is A Temporary Buydown

2 1 Buydown Intercap Lending

The Buydown Loan How To Get A Lower Rate The First Couple Years On Your Mortgage The Truth About Mortgage

What Is A Temporary Buydown Intracoastal Realty Blog

Curb Inflation With A Temporary Buydown

An Option For Rising Mortgage Rates Temporary Interest Rate Buydowns Ratebeat California S Best Mortgage Lender

Back Button

Lower Your Initial Monthly Payment With Fairway S Temporary Buydowns

![]()

Temporary Interest Rate Buydowns Florida Capital Bank Mortgage

3 2 1 Buy Down Mortgage Awesomefintech Blog