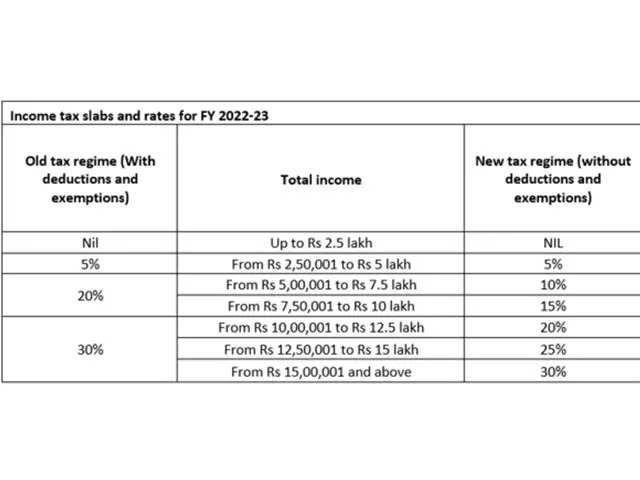

2022 tax brackets

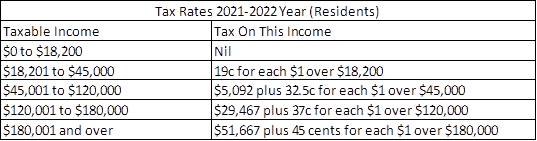

Resident tax rates 202223 The above rates do not include the Medicare levy of 2. The IRS changes these tax brackets from year to year to account for inflation.

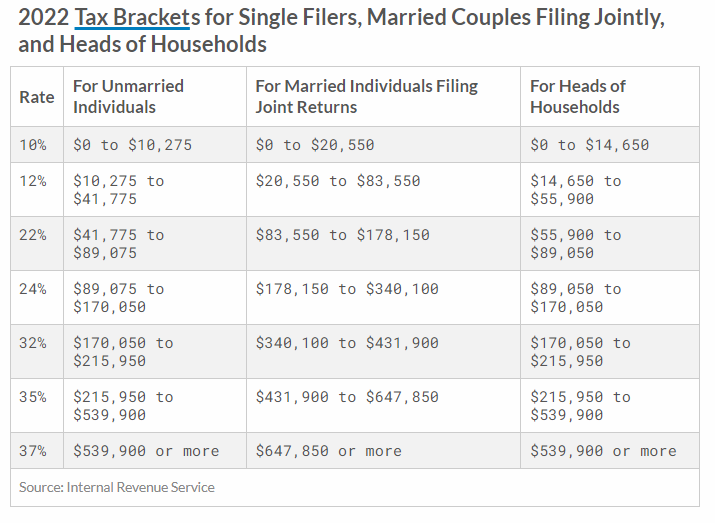

Budget 2022 Maintains Status Quo On Income Tax Rates Taxpayers Pay As Per These Slabs No Change In Personal Income Tax Slabs The Economic Times

Resident tax rates 202122 The above rates do not include the Medicare levy of 2.

. 12 hours ago2022 tax brackets for individuals. There are seven federal tax brackets for the 2021 tax year. The 2022 tax brackets affect the taxes that will be filed in 2023.

The 24 rate will apply to married couples filing jointly with incomes over 190750 or individuals with incomes over 95375. Federal Income Tax Brackets 2022. 16 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits.

A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable. The top marginal income tax rate. 2022 tax brackets Thanks for visiting the tax center.

1 day ago22 for incomes over 44725 89450 for married couples filing jointly 12 for incomes over 11000 22000 for married couples filing jointly. The 2022 and 2021 tax bracket ranges also differ depending on your filing status. The income brackets though are adjusted slightly for inflation.

Discover Helpful Information And Resources On Taxes From AARP. Federal Income Tax Brackets for 2022 Tax Season. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. The current tax year is from 6 April 2022 to 5 April 2023. These are the rates for.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year. The top marginal income tax rate.

The seven tax rates remain unchanged while the income limits have been adjusted for inflation. Each of the tax brackets income ranges jumped about 7 from last years numbers. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals.

Free tax filing software will find your tax bracket for 2021 with guaranteed accuracy. The table shows the tax rates you pay in each band if you have a standard Personal Allowance of. 10 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class.

10 12 22 24 32 35 and 37. Below you will find the 2022 tax rates and income brackets. There are seven federal income tax rates in 2023.

The agency says that the Earned Income. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Ad Compare Your 2022 Tax Bracket vs.

Income Tax rates and bands. Your 2021 Tax Bracket To See Whats Been Adjusted. 10 for incomes of single.

Ad Smart Technology Easy Steps User Friendly - 48 Star Loyal Customer Rating. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year. 13 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

To access your tax forms please log in to My accounts General information. The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022. Heres a breakdown of last years.

8 hours agoFor 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and.

The 32 rate will go to married couples. Your bracket depends on your taxable income and filing status. There are seven federal income tax rates in 2022.

Top 15 Federal Income Tax Brackets Tax Rates In 2022 Chungkhoanaz

Sales Tax Rate Changes For 2022 Taxjar

Everything You Need To Know About Tax In Australia Down Under Centre

2022 Tax Brackets Internal Revenue Code Simplified

2022 Federal Payroll Tax Rates Abacus Payroll

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

Taxtips Ca Ontario 2021 2022 Personal Income Tax Rates

State Income Tax Rates And Brackets 2022 Tax Foundation

Income Tax Brackets For 2022 Are Set

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

How Do Tax Brackets Work And How Can I Find My Taxable Income

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

New Income Tax Table 2022 In The Philippines

Twitter এ Tax Foundation 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw ট ইট র

Tax Brackets For 2021 And 2022 Ameriprise Financial

Uk Income Tax Rates And Bands 2022 23 Freeagent